Reflecting on the Anniversary of Hurricane Ida

It’s hard to believe that it’s been one year since Hurricane Ida, a category 4 storm that ravaged much of the eastern US and claimed an estimated 115 lives.

Hurricane Ida, which fell on the 16th anniversary of Hurricane Katrina, brought sustained winds of 150 mph (just 7 mph away from being classified as a category 5 storm).

The impact of Ida.

The hurricane was the 5th costliest storm in US history, causing over $75B in damage according to the National Centers for Environmental Information.

While Louisiana suffered an estimated 90% of the financial impact, the Gulf Coast was not the only affected area. The Northeast incurred billions of dollars in damages, with New York and New Jersey issuing flash flood warnings for the first time ever.

Devastating events like this are exactly why we are so adamant about the adoption of insurtech in the insurance industry.

Why we need insurtech.

The insurance industry can help policyholders during chaotic and confusing times by making sure their claims process goes smoothly. This will allow them to start rebuilding their lives as quickly as possible.

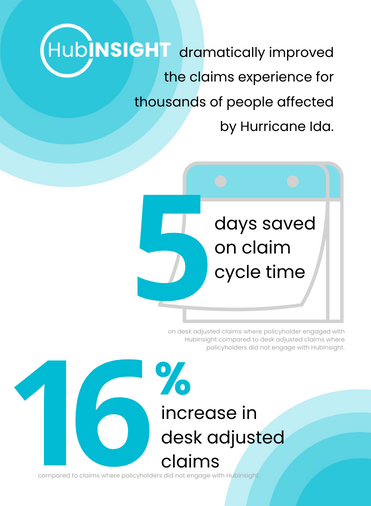

We achieve that by leveraging data and technology like our insured portal, HubInsight, which was able to dramatically improve the claims experience for thousands of people affected by Hurricane Ida.

On a sampling of 4,180 Hurricane Ida claims across two of our carrier partners, 59.5% of those policyholders engaged with HubInsight, uploading photos and documentation of their loss for triage.

Of those that engaged, we saw a 16% increase in the number of claims that were able to be desk adjusted and an average of 5 days saved on cycle time.

But insurtech can help policyholders before the storm even hits.

The future of claims.

While there is no way to prepare for the desolation of your home and community, insurtech companies like McKenzie Intelligence Services provide actionable intelligence to the insurance industry so that carriers can proactively notify their policyholders of impending damage.

By leveraging this data, firms can create highly strategic Catastrophe Response Plans and allocate the right resources to the appropriate areas.

According to CoreLogic, uninsured flood loss for Louisiana, Mississippi and Alabama was estimated to be between $6B and $9B but AI (artificial intelligence) and ML (machine learning)-enabled tools will learn from storms like Ida and allow the insurance industry to better predict future events and proactively analyze coverage.

Related Posts

March 25, 2021

How to Prepare Your Property for Hail

Here in central Texas we are no strangers to severe winds and hail but after…